West Virginia Opportunity Zone Benefits

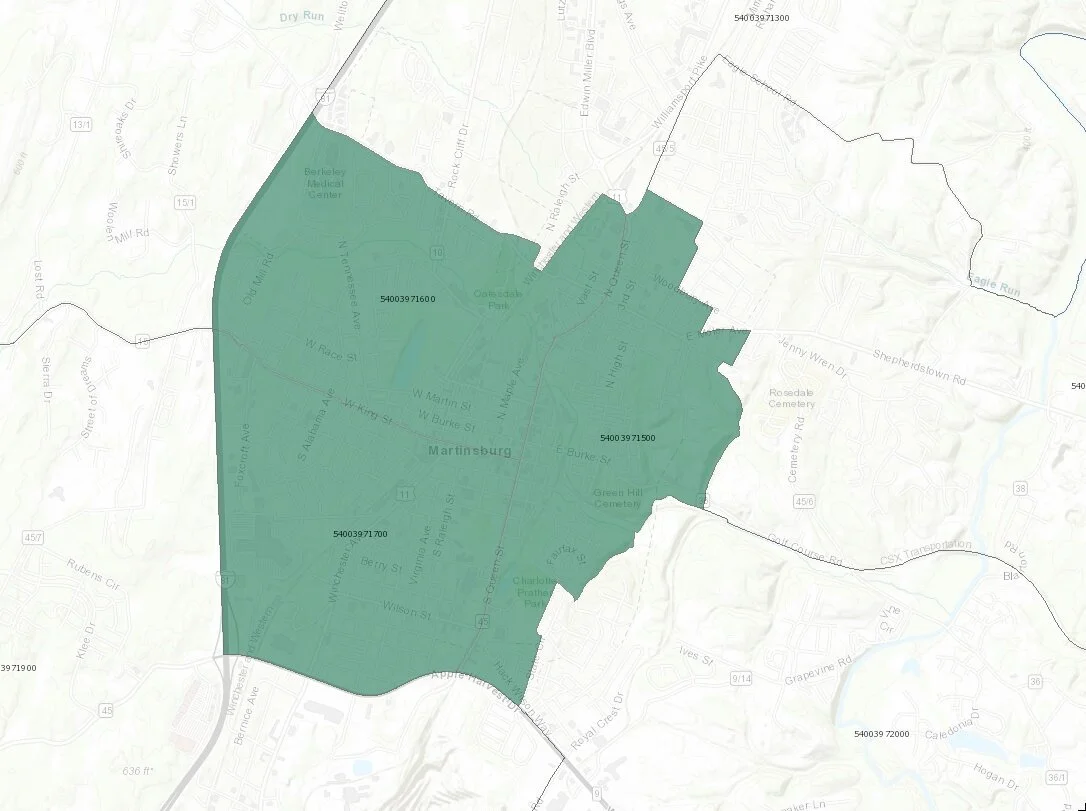

If your business is an LLC or Partnership formed between January 1, 2019 and January 1, 2024 within a West Virginia Opportunity Zone, you are likely eligible for forgiveness of state corporate and personal income taxes on income from that Opportunity Zone. Much of the City of Martinsburg falls within a Qualified Opportunity Zone.

A factsheet from the West Virginia Economic Development Office is available here.

In recent years, this incentive has been implemented by the simple inclusion of a line for “Qualified Opportunity Zone business income” on the appropriate state tax form. This amount is then subtracted from one’s taxable income.

The City of Martinsburg is unable to answer questions about your specific tax situation. Please refer specific questions to your tax advisor or to the West Virginia Tax Division. This information is provided as a courtesy to assist the City’s eligible businesses.